Contact Centers

Financial Services

Operations

Record

Voice

Balancing Customer Service and Regulatory Compliance in Financial Services

Natterbox Team

In today’s heavily regulated business environment, financial institutions must comply with a variety of laws and requirements to avoid costly and embarrassing penalties. Many banks and financial service institutions (FSIs) in the U.S., Europe, and Asia have been looking to ensure the activities of their traders and contact centers are compliant with these regulatory requirements.

Below we outline how FSI’s can find the healthy balance between great customer experience and contact center effectiveness, all while staying compliant.

The Story of Data Privacy and Regulation within Financial Services

Ensuring the safety of customers’ data is a key priority in an era of ever-tighter regulations and increasing cybercriminal activity. Breaches of credit card details, passwords or bank account information have sadly been a particularly common occurrence in recent years. And in the wake of a slew of high-profile corporate data breaches (affecting the likes of Yahoo, Marriott, and Facebook) and the proliferation of the data monetization business model,

92% of people in the US now express concern about their data privacy, and nearly 70% are more worried about it than ever before.

As consumers become increasingly data conscious, 87% now report they would not do business with a company if they had concerns about its security practices. As such, major regulatory bodies across the world have introduced a range of new legislation designed to alleviate consumers’ anxiety over how their data is collected and used, improve transparency of companies’ use of consumer data, and critically, establish new privacy requirements.

These most notably include the EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Now further US states have plans to follow suit and Germany rolled out new data privacy laws for telecommunications and telemedia in 2021. Though these regulations are putting increasing pressure on the financial services industry, they are critical, as the sector handles among the most sensitive types of consumer data. As such, while it’s the responsibility of financial services organizations to adhere to Know Your Customer (KYC) guidelines (which require the verification of customers’ identity, suitability, and various risks involved in a given business relationship), they must also look beyond this, to establishing new protocols and processes for achieving ongoing compliance while providing customers with the levels of service they want.

Improving Customer Experience with Privacy and Compliance in Mind

One of the biggest challenges for financial institutions is the ability to provide excellent customer service, whilst protecting data and transactions. It’s an enormous part of consumers’ expectations today, but it is at risk of being negatively impacted by adding new layers of security between the customer and the business.

Only 23% of customers believe FSIs handled the crises as well as they could have.

Salesforce report

However, without data security, businesses are at risk of losing their customer’s trust and ultimately affecting their bottom line. It’s a fine line to walk.

A huge part of maintaining this trust is compliance with the variety of laws and requirements in today’s heavily regulated business environment, which are there to ensure financial services companies remain insured and avoid costly — and embarrassing — penalties.

Failure to do so gives extremely poor impressions to both existing customers and future prospects.

As such, many banks and financial services companies in the U.S., Europe, and Asia have been looking to ensure the activities of their traders and contact centers are compliant with these regulatory requirements.

However, call recording compliance in particular is a cumbersome regulation; noncompliance can cost banks and financial institutions hundreds of thousands or even millions of dollars. Not only should calls be recorded for compliance, it’s what is said or not said on the call that also needs to be heavily monitored.

Meeting all these requirements and regulations will require a transformation of business’ people and processes, but perhaps most importantly, their technology. Central to achieving these objectives will be the adoption of best-fit technology solutions, for example, cloud-based communications platforms. These platforms not only give customer service agents the tools and ability to provide a better experience for customers, but are able to simplify processes like call recording, data collection and customer segmentation. Automation and AI-driven tools are also crucial in the world of financial services. Without them, companies are often left with unstructured, unorganized data that they can’t leverage to its full potential. After all, leaving employees to organize data is inefficient and time-consuming – not to mention, it’s a process prone to human error.

It’s no wonder over 90% of financial service firms using intelligent automation are reaping positive ROI.

Bank Automation News

If leveraged appropriately, the right solutions not only ensure that financial services organizations meet critical regulatory requirements, but also empower them to better know their customers, improve the customer experience, and drive their bottom line.

Making Voice a Secure and Regulated Channel

While today’s customer is using a number of channels to interact with brands — email, text, chatbot, social media, video, and more — voice remains a keystone of customer communications.

In fact, up to 92% of customer interactions still take place over the phone, according to Salesforce.

State of Service report

For financial institutions, voice interactions present the ideal opportunity to establish a sense of trust with the customer, but must also be heavily regulated. Many financial institutions find themselves trying to reach compliance standards through expensive quality assurance and compliance overheads for call monitoring.

This requires human input to thoroughly examine the content of a call for certain words and phrases, which is not only costly from a personnel perspective, but gives way to human error. This approach also means that not every call will be checked due to the sheer volume of calls most

organizations have every day.

This is where a tool like Natterbox’s 100% Salesforce-integrated cloud-based voice solution can make all the difference. Not only can you record calls to give companies full visibility over calls with their customers and how call agents handle the customers’ data, but it also stores the recordings securely and compliantly in our ISO27001:2013-certified cloud infrastructure, from which they can be played back in Salesforce. Deploying best-fit technology solutions at the service level up, throughout the entire organization, enables financial services firms to more seamlessly and compliantly collect and manage

consumer data.

How Intelligent Customer Experience Technology Enables a Secure and Compliant Way to Manage Data

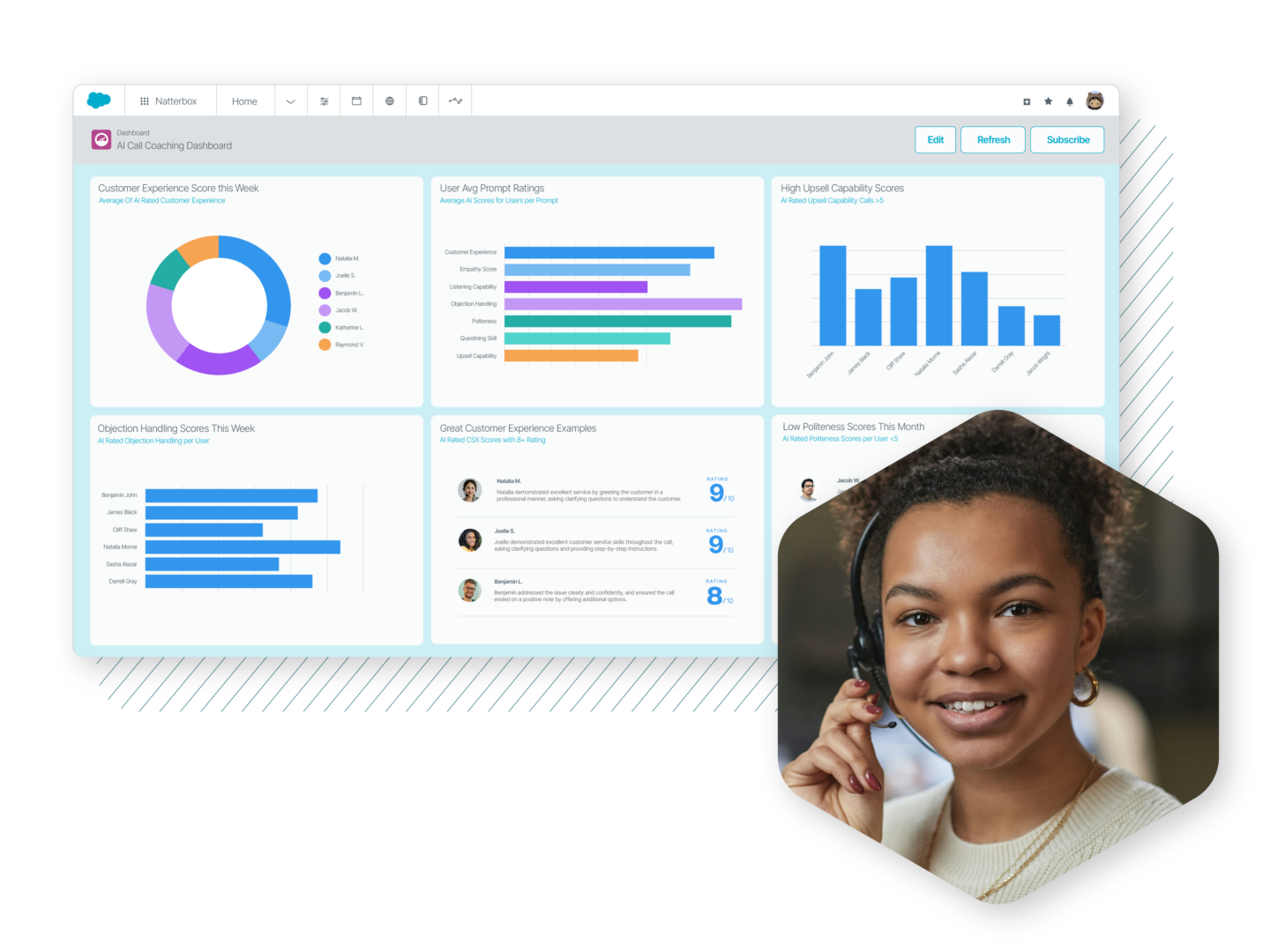

In addition to our cloud-based platform, Natterbox Insight, a cutting-edge, AI-powered speech analytics solution, automatically captures and analyzes recordings in transcriptions. This means supervisors can have visibility over every call and ensure all agents are being 100% compliant all of the time, without even having to listen to each conversation themselves.

Insight recognizes phrases and compliance statements that it has been trained to listen out for, such as ‘This call is being recorded for the purpose of…’ In doing so, the intelligent tool eases the burden of manual call recording and time-intensive listen-back, which most financial organizations require for compliance and training purposes.

Further, Natterbox Insight leverages emotional intelligence-based algorithms to highlight keywords and topics that arise throughout a given conversation, as well as flagging specific instances in which the customer expressed strong positive or negative emotions. This helps agents to pinpoint common pain points and make better data-driven decisions that improve the customer experience. Natterbox is additionally backed by an International Standards Organization ISO27001:2013 certification that guarantees the secure handling of all customer data, so financial services firms can rest assured that they are not only providing a personalized service, but also a compliant one to every customer.

Building Long-Term Consumer Trust

There is not a week that goes by that headlines don’t include the latest data breach in which personal, consumer data is put at risk. It’s no surprise that the public is increasingly worried about what happens to their financial data when it’s disclosed to multiple companies with every interaction they take part in.

Consumer trust is therefore now effectively the hardest thing for companies to gain and retain and if breached, customers will not think twice about moving to a competitor. That’s why regulation is vital.

So, delivering a competition-crushing customer experience does not only require companies to find new ways to anticipate demand and navigate the challenge of providing personalized service, but to ensure they have reliable and transparent regulatory compliance practices in place to maintain their customer’s trust. More often than not, technology and automation are your best tools for meeting compliance standards and building long-term customer trust.

Natterbox empowers financial services organizations to provide world-class personalized, secure, compliant, and transparent customer service while elevating productivity and boosting top-line performance.

Questions for Consideration

We hope this has provided you with plenty of food for thought. Finding the right balance between top-standard customer service while maintaining compliance can feel daunting for many financial services institutions, but is easy when the right tools and technologies are implemented.

So, before you go, here’s a list of helpful key considerations for the questions that should be front of mind:

- Do you currently record your calls?

- Where are your recordings being stored and how long for?

- Are these recordings easy to access?

- How much is your company currently spending on QA and compliance overheads?

- How much could your company save through automation?

- How many hours does it currently take to scan call recordings?

- How confident, on a scale of 1-10 are you, with how compliant your customer calls are?

- What is your current telephony experience like?

Natterbox has helps financial companies like N26, Funding Options, Eightcap and Canada Life. Could we also be helping you?